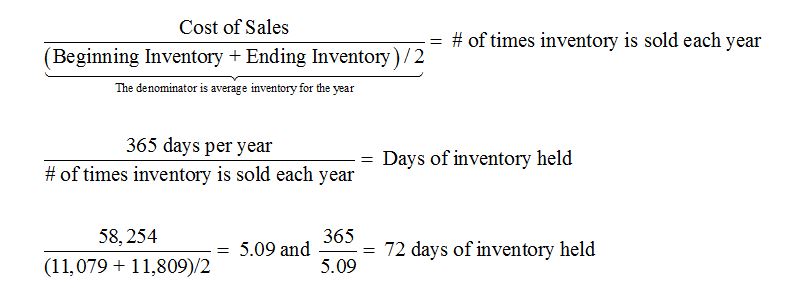

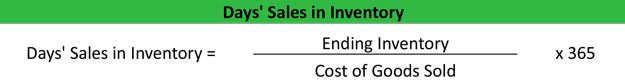

It is important to realize that a financial ratio will likely vary between industries. How many days will it take for your company to sell its entire inventory Well, if you have no idea, then you can calculate the Days Sales in Inventory. Since sales and inventory levels usually fluctuate during a year, the 40 days is an average from a previous time. To illustrate the days' sales in inventory, let's assume that in the previous year a company had an inventory turnover ratio of 9. Using 360 as the number of days in the year, the company's days' sales in inventory was 40 days (360 days divided by 9). The calculation of the days' sales in inventory is: the number of days in a year (365 or 360 days) divided by the inventory turnover ratio. Therefore, you should view this as an average from the past. Keep in mind that a company's inventory will change throughout the year, and its sales will fluctuate as well. The financial ratio days' sales in inventory tells you the number of days it took a company to sell its inventory during a recent year. Doing both of these requires tightly managed and carefully planned systems.What is the days' sales in inventory ratio? Definition of Days' Sales in Inventory Having a quick cash conversion cycle shows that management has devised ways to reduce time wasted by the business by keeping items in inventory for a short time and getting payment for goods quickly.

DAYS SALES IN INVENTORY FORMULA PLUS

In retail or wholesale, the cost of goods sold is comprised of merchandise that was purchased from a manufacturer, plus the expenses associated with acquiring, storing, and displaying inventory items. For the service industry, cost of goods sold includes labor expenses, including wages, taxes and benefits. The cost of goods sold is the direct expense associated with providing a service or producing a product.

Average Inventory: Cost of Goods Sold (COGS) or Net Sales: Number of Days: Day of Sales in. This article has been viewed 684,785 times.ĭetermine the cost of goods sold. Days Sales in Inventory Day of Sales in Inventory Avg. This article received 13 testimonials and 89% of readers who voted found it helpful, earning it our reader-approved status. WikiHow marks an article as reader-approved once it receives enough positive feedback. There are 9 references cited in this article, which can be found at the bottom of the page. Mack Robinson College of Business and an MBA from Mercer University - Stetson School of Business and Economics. The following section describes each parameter involved in the above formula.

She holds a BS in Accounting from Georgia State University - J. Days in inventory (average inventory /cost of goods sold (COGS)) x period length. Keila spent over a decade in the government and private sector before founding Little Fish Accounting. With over 15 years of experience in accounting, Keila specializes in advising freelancers, solopreneurs, and small businesses in reaching their financial goals through tax preparation, financial accounting, bookkeeping, small business tax, financial advisory, and personal tax planning services. Keila Hill-Trawick is a Certified Public Accountant (CPA) and owner at Little Fish Accounting, a CPA firm for small businesses in Washington, District of Columbia. This article was co-authored by Keila Hill-Trawick, CPA.

0 kommentar(er)

0 kommentar(er)